How Blockchain Empowers Social Media: on the mechanics of token economy and decentralization? [Part 3 The Token Economy]

— Stories behind three typical paradigms: Steemit, Bihu, and Voice

Executive summary about tokenized social media

Nowadays, users have an increasing demand for decentralized platforms when censorship, privacy disclosure, and security of personal data are severely concerned in traditional social media. The innovative blockchain technology perfectly solves this dilemma by reducing the trust cost, protecting users’ freedom of expression, and serving as a reliable framework of the peer-to-peer (P2P) network.

Taking a further step, a few social media companies have introduced the token system into their platforms. Tokenized social media connects the platform and users through their consensus on the token value. Moreover, the token economy incentivizes users to contribute their intelligence to the virtual community and participate in on-chain governance. In this article, we will introduce three typical tokenized social media, Steemit, Bihu, and Voice, in facets of their business models, token design, as well as insightful analysis about its strengths, weaknesses, opportunities, and threats (SWOT). Finally, we will discuss how tokenized social media revolutionizes the online communication ecology and builds the future community of diversity and inclusion.

To recap, in Part 1, we provide a brief introduction to three representative tokenized social media. In Part 2, we conduct a SWOT analysis on the business model and provide further strategic advice. In Part 3, let’s take a closer look into the token economy.

Part 3 The Token Economy

Token mechanisms are extremely important for these decentralized social media, where tokens are produced and distributed to the whole community in order to maintain clients’ enthusiasm and activeness on the platforms. Now we will cover and describe these token designs of the three typical decentralized social media in the following five aspects:

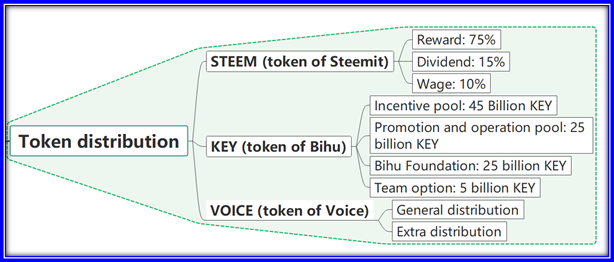

Figure 1: Mind map of Token Design Brief

1. Token distribution

Figure 2: Mind map of Token distribution

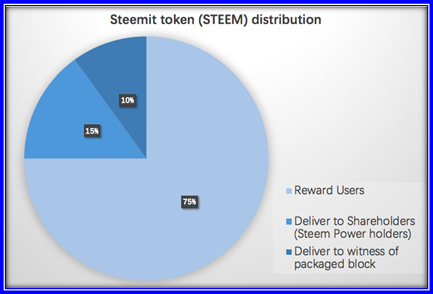

1.1 STEEM (token of Steemit)

Community members are rewarded with tokens including 50% in Steem Power and 50% in Steem Dollars.

For STEEM:

(1) Reward: 75% of the newly added steem each year will enter the reward, and the creators and screeners in the community will be given tokens through a special algorithm;

(2) Dividend: 15% will be directly distributed to the community shareholders (those who hold the steem power);

(3) Wage: 10% will be assigned to the witnesses of the packaged block (those who write the transaction record on the chain).

For Steem Power:

A more amazing article would obtain more Steem Power.

Figure 3: Pie chart of Steemit token (STEEM) distribution

1.2 KEY (token of Bihu)

The total amount of KEY is 100 billion, which is divided into 4 parts according to the white paper: incentive pool, promotion and operation pool, Bihu Foundation, and team options.

(1) Incentive pool: 45 billion KEY, locked by the smart contract, 10% of balance is released every year.

(2) Promotion and operation pool: 25 billion KEY. The early recommendation and reward plan is the most powerful.

(3) Bihu Foundation: 25 billion KEY for technical development, operation subsidization, and maintenance costs.

(4) Team option: 5 billion KEY, exercised in 5 years, with 1% exercised every year.

Figure 4: Pie chart of Bihu token (KEY) distribution

1.3 VOICE (token of Voice)

The total amount is unknown, and only registered users can hold VOICE tokens. There are two main token distribution channels:

(1) General distribution: VOICE are given to new users when they sign in every day.

(2) Extra distribution: Users receive tokens by watching ads, posting, commenting, liking, and reporting illegal/unauthorized posts.

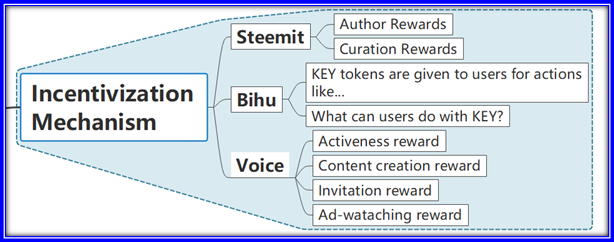

2. Incentivization Mechanism

Figure 5: Mind map of Incentivization Mechanism

2.1 Steemit

You can use your bain to earn Steemit in two ways.

(1) Author Rewards: When you publish a post or a comment and other users upvote it, you earn author rewards.

(2) Curation Rewards: When another author publishes a post or comment and you determine it to be valuable enough to upvote it, you get rewarded a share of the value of your upvote as curation reward.

2.2 Bihu

KEY tokens are given to users for actions:

(1) Posting high-quality contents;

(2) Finding high-quality contents (by liking and commenting);

(3) Managing and cultivating excellent topic sections;

(4) Watching advertisements.

What can users do with KEY?

(1) To purchase premium services on the platform;

(2) To pay to attend special and knowledgeable events (e.g., Q&A);

(3) To reward the articles or posts.

2.3 Voice

VOICE tokens are given to users in the following scenarios:

(1) Activeness reward

Users can get VOICE tokens by registering, logging in Voice, speaking on or commenting on Voice, etc.

(2) Content creation reward

All users can post content, and the platform rewards users with tokens based on their feedback on that content. In contrast to Bihu where users who possess a larger amount of KEY will get more rewards when they create content and the content is recognized by the community, Voice only cares about the quality and popularity of the content, but has nothing to do with the size of the token shares.

(3) Invitation reward

Users can get VOICE when they invite other people to join the Voice community. Moreover, it can happen as long as users promote the platform or even the blockchain technology itself, and make contributions to the blockchain ecosystem behavior reward.

(4) Ad-watching reward

Users get paid when they watch an advertisement.

3. Token supply

Figure 6: Mind map of Token supply

In this Section, we briefly illustrate the token dynamics of decentralized social media platforms.

Two reasons may lie behind Steemit and Voice’s coin inflation. First, the platform can raise funds by creating new tokens, just like the central banks printing money. Second, these newly created tokens would be the source of rewards given to registered clients and their contributions to the virtual community. For example, Voice adds 10% new tokens into circulation every year.

However, Bihu has restricted its token supply on a yearly or weekly basis. Bihu wants to encourage users to hold tokens and stay in the community. This can be explained with a classical model of demand and supply. When the token of Bihu, KEY, decreases in its amount, the upward-sloping supply curve shifts to the left. Then, the new intersection, which is higher than before, represents a greater value of the same token. As a result, users are more likely to hold KEY tokens and thus are more “faithful” to the platform. Besides, as users all know that the price of KEY will be increasing due to the supply cut, they sell less and thus provide greater price stability.

Bihu reduces token supply mainly by eliminating part of the advertisement revenues, also known as the “coin burning mechanism”. Product companies pay a certain amount of tokens to Bihu for the chance to share their advertisements. Traditionally, in centralized social media, people are forced to watch advertisements. Ads consume people’s time, energy, and patience, but benefit the audiences nothing in most cases. However, Bihu, as a tokenized social media, divides the advertisement fees into two parts. 45% fees are given to registered users who view the ads. The remaining 55% fees, instead of incorporating into the platform’s assets, are sent to the black hole account for which address you can only send tokens in but cannot turn them out. Since 2021, Bihu has burnt 80% of the balance of the incentive pool on a weekly basis.

4. On-chain Governance

Steemit has an on-chain governance mechanism:

Steem Power holders are tasked through on-chain voting. Witnesses are also responsible for voting on changes to the consensus rules (i.e. hard forks). If token holders do not believe that a particular witness or group of witnesses are performing their duties properly, they will unvote them and vote in new witnesses to take their place.

Meanwhile, no official documents or public resources clearly indicate that Bihu and Voice has a definite on-chain governance structure.

5. Historical Data

From CoinGecko, we successfully acquired the data for all three tokens and visualized their price and market cap changes, as well as the calculated token supply, which is market cap divided by token price.

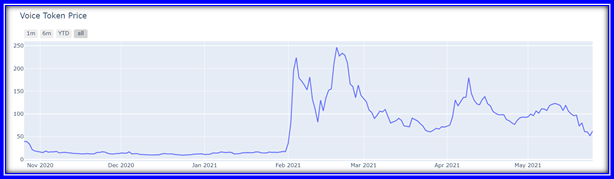

5.1 Voice Token Data

Figure 7: Change of Voice token price

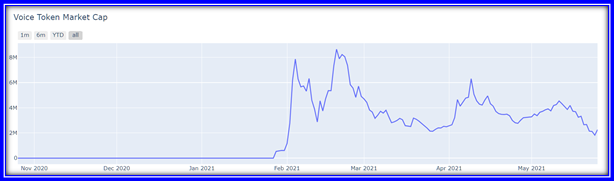

Figure 8: Change of Voice token market cap

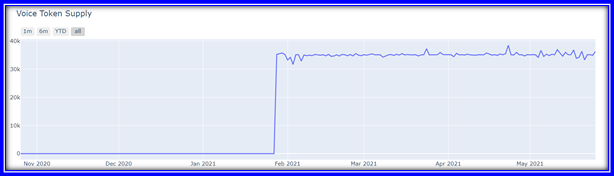

Figure 9: Change of Voice token supply

As shown in Figure 9, the whole supply of Voice tokens doubles and then remains relatively stable around the amount of 35 thousand since late January 2021.

5.2 KEY Token Data

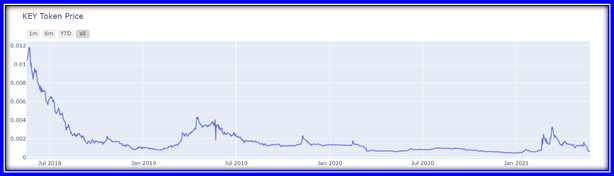

Figure 10: Change of KEY token price

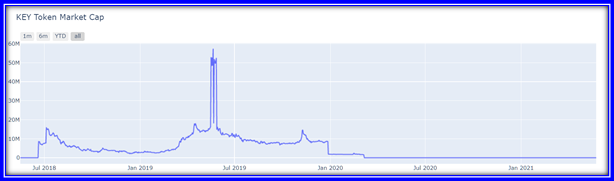

Figure 11: Change of KEY token market cap

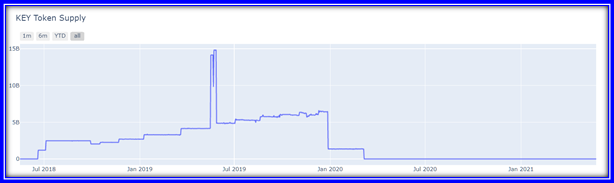

Figure 12: Change of KEY token supply

As shown in Figure 12, the whole token supply of KEY increased at a moderate speed before 2020. Sooner it rapidly decreased after January 2020, and we failed to find any reliable sources to determine the market cap after March 2020.

5.3 STEEM Token Data

Figure 13: Change of STEEM token price

Figure 14: Change of STEEM token market cap

Figure 15: Change of STEEM token supply

As shown in Figure 15, the whole market supply of STEEM increases gradually.

Acknowledgments:

Authors: Ray Zhu, Tianyu Wu

Design: Austen Li

Assistant Editor: Zichao Chen

Associate Editor: Xinyu Tian; Executive Editor: Lunji Zhu

Chief Editors: Prof. Luyao Zhang, Prof. Yulin Liu