Algorithmic Trading in Crypto Market

An ecosystem for investors, managers, and developers

Table 1 presents over 10 typical algorithmic trading products you can choose in the crypto world! In each algorithm, developers assistant managers to make the portfolio of crypto assets, aiming at high return for investors through transactions and investments. Let’s prosper together in the merging ecosystem!

Table 1: Ranking of Return of Various Algorithms in Crypto Investment

Table 1: Ranking of Return of Various Algorithms in Crypto Investment

Introduction

In designing algorithms for crypto investments, three platforms, Set Protocol, Enzyme, dHEDGE, stand out in the industry. The functionalities of these three platforms are almost similar to the Exchange Traded Funds (ETFs) in the traditional stock market. It allows clients with different demands to serve as roles including investors, managers, and developers. They altogether build an ecological world for cryptocurrency investment. In the following part, we will mainly take typical TokenSets in the Set Protocol as examples and describe its mechanisms, to better understand how people can utilize the technology to better manage their assets.

The Ecosystem Mechanism

How can different types of people operate on Set Protocol?

In TokenSets, a product for portfolio management from Sets, customers can create their own “Set” or trade their Sets with different strategies. As described in the white paper, Set is “an abstract, fungible token fully collateralized by its underlying tokens”. And with its composite tokens, Set makes it possible to reduce transaction fees for ERC20 tokens, focus on higher-level concepts (i.e., multiple layers building), promote the minting value with the underlying tokens, and avoid counterparty risks.

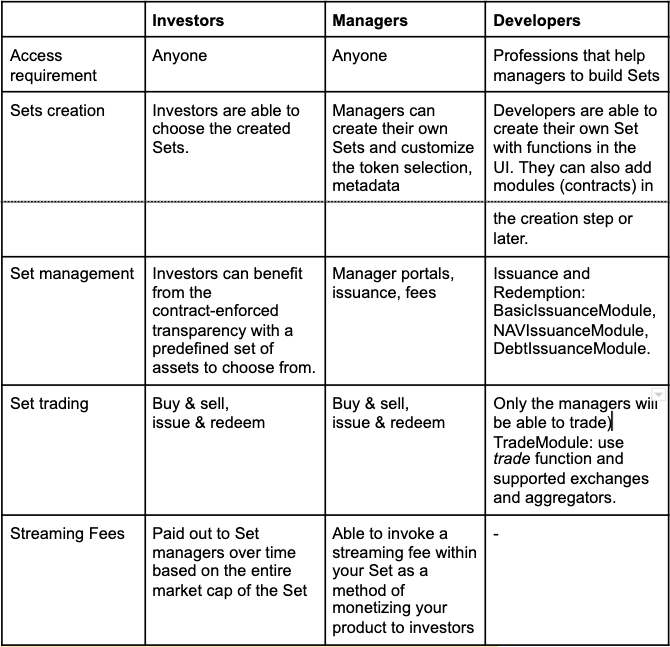

For customization, users can switch their roles between investors, managers, and developers on their own:

Table 2: Comparison between three roles in Set Protocol

Table 2: Comparison between three roles in Set Protocol

How can Sets operate to benefit customers?

Figure 1: Set Protocol’s operations for customers with different characters

- Structured Products: Index Token/ETF

Several crypto indices have been created in Set to meet the market needs or niche. As a basket of tokens, Sets take advantage of the integration of the underlying tokens and reduction of cross-protocol operation costs that benefit all the stake-holders, including investors, managers, and developers.

For investors, the Set offers lower transaction costs, diverse assets, lower maintenance requests, and easier tracking tools. In traditional investment, customers have to purchase several individual tokens and pay high trading fees for makers and transaction fees for network operations. And the active trading of their assets is a time-consuming action. With the comprehension of tokens, Sets can work as a unit in exchange platforms that literally users only purchase on one token. And with the fluctuation of the underlying tokens, users only need to rebalance the Sets with the updated ones or issue a Rebalancing Set. Users can lower the trading risks with Set issuance and redemption or trading for other Sets.

For managers and developers, Sets are similar to Exchange-traded-funds that support creation and redemptions. However, compared with the traditional ETFs, traders can serve as the liquidity providers to normalize the Set price deviation, preventing the large deltas between the Set price and the Set’s aggregate component value.

2. Long/Short Set

Sets can also be classified into long or short Sets. In the long Set, an R-Token Security Token is applied through a smart contract to guarantee compliance when to accord to the appropriate regulatory bodies and with the requirements written by the initial issuer. In addition, a dYdX token is used in the short Sets, to provide traders with a simple way to get short and leveraged long exposure to crypto-assets. The combination of both a long and margin set is beneficial for the investors to identify the strategies in both long and short terms, in order to maximize the return of investment.

3. Multi-Token Use Case

The Sets are combinations of tokens, which are efficient in comprehensive investment, market-making, and other advanced derivatives. And the Sets can be a good fit for representative units in the market demand of synthetic assets and combined tokens. Since decentralized applications (dApps) take the advantage of multiple protocols and require different tokens, the Sets are well-fitted in composite work. It benefits the developers in programs to call cross-protocol functions between smart contracts and decentralized exchange platforms.

And besides dApps, there are more crypto-native use cases for Sets that are yet to be found. Some of the listed are Composite StableCoin, Protocol Collateral, Hedged Bet, and Fractional Ownership of Non-Fungible Assets.

4. Issuance and Redemption

In the traditional financial market, investors cannot make their efforts to change the token supply, however, it is applicable to both issues and redeems the tokens. Specifically, issuing a token is to mint new tokens for a particular Set. It is a two-step process, including depositing funds into the Vault and then issuing, to put it another way, it means firstly attributing components to the Set and then minting a Set token to the user. Users can incrementally deposit tokens into their vault before issuing, as issuance uses a combination of the user’s tokens in their wallet as well as their tokens in the Vault. With a valid deployed Set, anybody can convert a specified mix of ERC20 tokens into a Set token.

On the contrary, Redemption is the process of converting a Set into its underlying component tokens. Redeeming tokens reduces the token supply of Set tokens in the contract. It involves burning a Set token and attributing the components to the end-user.

And specifically for developers, Set provides several issuance and redemption functions, including BasicIssuanceModule, NAVIssuanceModule, and DebtIssuanceModule, which differ in positions of the issued SetTokens.

Case Studies

In order to help clients better understand the different Sets in all the portfolios, we here take two typical examples since those who have no experience in crypto investment are quite unfamiliar with these different strategies. Smart contracts are initially built in those cryptocurrencies, however, due to the lack of professional knowledge in code construction, people may not clearly comprehend the exact idea of portfolios. Thus, here we use plain words and connect some terms in the traditional world for an easier understanding.

Figure 2: Investor Decision Tree For Set Protocol

Case Study 1: DeFi Pulse Index

From the Set Protocol platform, there is a DeFi Pulse Index in the Set, serving as a capitalization-weighted index that tracks the performance of decentralized financial assets within the DeFi industry, through holding a wider selection of tokens. The index is weighted based on the value of each token’s circulating supply and aims to track projects in Decentralized Finance that have significant usage and show a commitment to ongoing maintenance and development. This actually creates a diversified portfolio, which always behaves less volatile and could obtain downside protection, compared to some concentrated portfolios. In addition, the use of market capitalization for component weights would prevent the investors from suffering underperformance due to some impermanent loss.

For a newcomer in the DeFi industry, the DeFi Pulse Index is actually a blockchain financial product that lowers the barrier to entry for new users who lack the expertise to gain exposure to DeFi and provides experienced users with exposure to DeFi through one single asset.

Case Study 2: The Quant

Another example is called “The Quant”, where it leverages machine learning and regression analysis to generate signals to automatically rebalance between Bitcoin and a Stablecoin. This portfolio is constructed in partnership with a leading multi-strategy cryptocurrency hedge fund for institutional investors. It is not hard to see that this strategy aims at a higher return of investment. According to the description of its rebalance strategy, it shows that it is devoted to capturing more than 80% of Bitcoin’s returns while effectively improving risk versus long positions by exiting in downward trending markets.

This strategy is completely different from that above, which shows a distinctive difference in the selection of investment strategy for investors in particular, and here we offer a lucid chart for those with different backgrounds to select a more suitable strategy in DeFi investment.

Conclusion

In this article, we take Set Protocol as an example to identify existing algorithms used in the real crypto investment world. Compared to Enzyme and dHEDGE, Set Protocol has a more user-friendly interface for digital asset management that enables ordinary users to access a wide range of financial instruments and products. But dHEDGE also brings new ways of using liquidity in the derivatives market, and Enzyme is currently integrated with the most decentralized exchange protocols as Oasis, Kyber Network, 0x, and Uniswap. However, there are no scholars systematically evaluating the return and risk, Sharpe Ratio, or Return of Investment (RoI) in these portfolios, and this implies that our further research would primarily focus on the evaluation of different portfolio management in the crypto investment, including asset classes, a hedged set, a composite set of stablecoins, etc.

Since this is quite a new topic and we have identified a great number of interesting research opportunities and potential strategies for ecosystem stakeholders. Thus we draft this medium article as a starting point to inspire seminal research and applications.

Authors: Tianyu Wu, Xinyu Tian, Summer Research Scholars at Duke Kunshan University 2021, on the Fintech project team lead by Prof. Luyao Zhang

This article is a deliverable out of the Summer Research Scholar Program

Acknowledgments:

Design: Austen Li

Project Lead and Chief Editor: Prof. Luyao Zhang